As The Country Reopens, Safety Concerns Rise

Consumers not headed back to physician offices anytime soon; despite that telehealth use grows unequally by age, income, and gender

Market Pulse reports as seen in

Our third survey confirms a growing demand for telehealth services, especially in mental healthcare, as social isolation takes its toll and fear of contracting the virus keeps people out of emergency rooms and doctors’ offices. We also gained a better understanding of how age, gender and income affect perceptions of telehealth.

The third COVID-19 Black Book Market Research/ Sage Growth Partners (SGP) survey of U.S. consumers, conducted from April 28 to 29, repeated questions found in the first two surveys and added a number of questions that helped us explore new areas of interest.

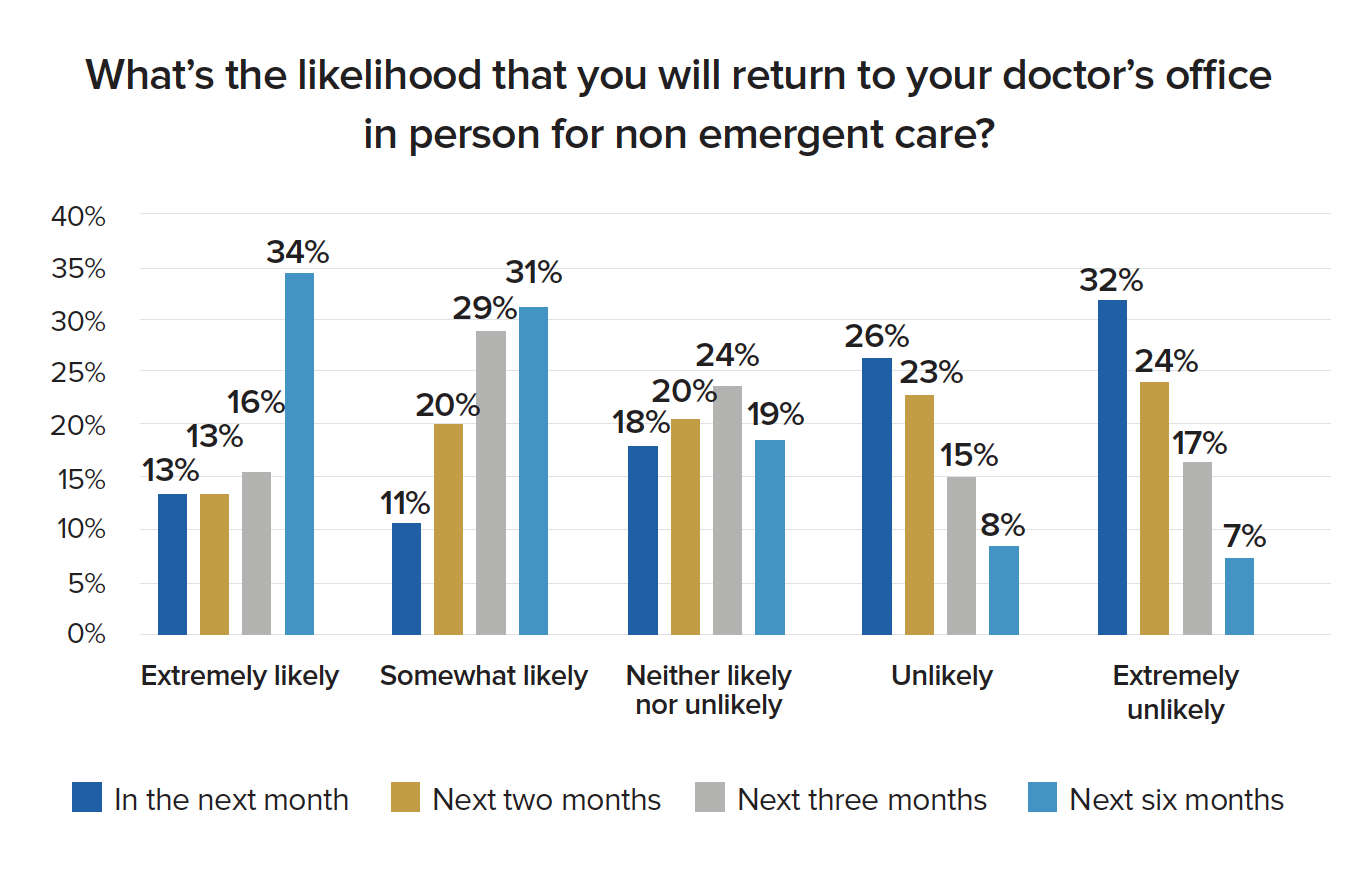

The 591 consumers who responded continue to feel anxious, though levels have dipped down slighly to those seen in March. However, these fears are keeping people away from their doctors’ offices and hospitals as they delay and avoid care for chronic conditions, illnesses, and injuries because of concern about potential exposure to COVID-19. This hesitancy to seek care at brick and mortar facilities is driving increased demand for telehealth services.

Our findings also brought to light differences in attitude about telehealth based on the respondent’s age, gender, and income level, which raises interesting questions about whether those who will most benefit from telehealth will actually be willing and able to adopt virtual care.

Other headlines from this study:

- We’re not getting back to business as usual any time soon. Fear of seeking in-person care at healthcare facilities is rising.

- Telehealth appears to be an effective means of accessing care. Fear of COVID-19 is making people less likely to seek in-person care, so many are now turning to telehealth to get the care they need—and they’re having positive experiences.

- The more money you make, the more likely you are to have and use telehealth services. In addition to age as factor in adoption of telehealth, income also plays a role.

- Anxiety dips but remains high; more than a third still want more access for remote behavioral and mental health services. Ongoing isolation, the stress caused by seismic changes to daily routine, worry that they or someone they care about will contract COVID-19, fear of a second wave of the pandemic, and the increasing financial woes about the pandemic continue to fuel high levels of anxiety.

- We’re not all having the same telehealth experience. Men and women’s views differ sharply. Although both men and women are turning to telehealth for care, they’re not doing it the same way.

- Trust in leadership’s handling of COVID-19 at all levels of government has plummeted. As the pandemic wears on, on the political front people are unhappy with how their federal, state and local governments are handling the COVID-19 crisis.

Lessons Learned

The COVID-19 pandemic is reshaping the healthcare landscape and we likely won’t return to the way things used to be. Telehealth services have moved to the forefront as people delay or avoid seeking care at brick and mortar healthcare facilities for fear of contracting the virus. We believe the growing acceptance and use of telehealth signals an opportunity for healthcare providers to develop new, expanded models of care delivery for the future, offering patients a choice of how they prefer to engage with providers—in-person and virtually.

Payers have already taken note. Medicare and commercial carriers have added telehealth benefits and increased reimbursement rates for telehealth. Even CMS Administrator Seema Verma has declared that it is unlikely that these expanded benefits will disappear post-pandemic.

For more of our conclusions and insight on this survey, please download the report below.

Methodology

Sage Growth Partners (SGP), a Baltimore-based healthcare research, strategy, and marketing firm, conducted the survey in partnership with Black Book Market Research. This is the second survey aimed at assessing the challenges, needs, and perspectives of U.S. healthcare consumers during the COVID-19 pandemic. It was administered to 591 U.S. healthcare consumers the week of April 27, 2020. SGP and Black Book plan to periodically re-administer the survey to monitor changing attitudes during the crisis.

The data was representative of all states, and across genders and ages; as the sample fell into the norm, it did not require any weighting. Our data collection has a standard margin of error of (+/-) 5% with a 90% to 95% level of confidence.

About Sage Growth Partners

Sage Growth Partners accelerates commercial success for B2B, B2B2C, and B2C healthcare organizations through a singular focus on growth. The company helps its clients thrive amid the complexities of a rapidly changing marketplace with deep domain expertise and an integrated application of research, strategy, and marketing.

Founded in 2005, Sage Growth Partners is located in Baltimore, MD, and serves clients such as Philips Healthcare, U.S. Renal Care, Quest Diagnostics, Vocera, Livongo, Olive, It’s Never 2 Late, and Aperture.

About Black Book

Black Book Market Research LLC, its founder, management, and staff do not own or hold any financial interest in any of the consultants and advisory firms covered and encompassed in the surveys it conducts. Black Book reports the results of the collected satisfaction and client experience rankings in publication and to media before firm notification of rating results and does not solicit survey participation fees, review fees, inclusion, or briefing charges, or involve consultant firm collaboration with Black Book before the announcement of the polling outcomes.

In 2009, Black Book began surveying the client experience of healthcare software and managed services users, as well as polling for trend identification, industry insights, and outcomes. Black Book expanded its survey prowess and reputation of independent, unbiased crowd-sourced surveying to technology professionals, physician practice administrators, clinicians, user-level staff, financial leaders, executives, and board members. Consultants and advisor satisfaction polls were first issued in 2011. In 2012, Black Book included payer organizations and insurers and, in 2015, launched panel surveying healthcare consumers

Download the Latest Report

Fill out the form below to download the PDF report, get more information about this study, and to receive automatic emails to the weekly pulse updates.